Balance Sheet Explained

What does the Balance Sheet tell us about your company?

What is important to look at in your Balance Sheet?

How do you read your company’s Balance Sheet?

A Balance sheet tells you what your company owns, owes, and how much shareholders have invested.

This statement is one of the three core financial statements used to evaluate your business. It is a snapshot of your company’s finances at a specific point in time.

The importance of this financial statement is significant because it allows your company to calculate rates of return and to evaluate its capital structure.

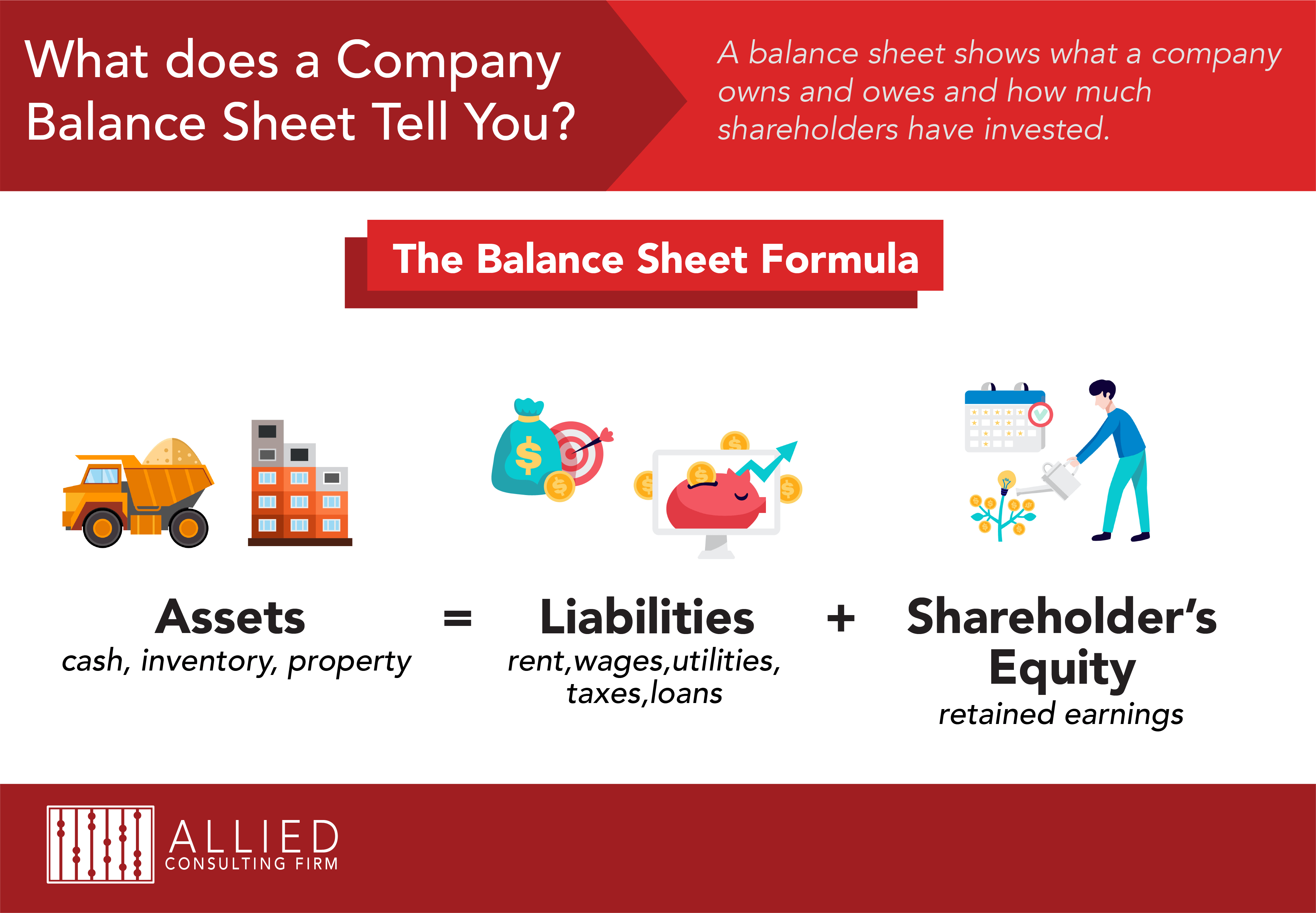

The Balance sheet is based on the following formula:

ASSETS = LIABILITY + EQUITY

Let us explain each component of the Balance Sheet.

ASSETS: The assets are what your company owns, which are:

– Cash, money in the banking account (checking or savings)

– Account Receivables which are the bills that your company submits to its clients; pending to be collected.

– Equipment, Cars, or trucks

– Land, or estate property

– Patents, goodwill

The Assets in your company is classified by “Current” and “Fixed”. This distinction is based on its item’s liquidity. So in this instance money in the bank is more liquid than account receivables, and account receivables are more liquid than equipment.

Fixed assets are basically your equipment, cars, trucks. All of which will depreciate during its productive life.

LIABILITY: Is the money that a company owes to outside parties which are:

– Credits Card debt

– Account Payables from bills due to suppliers or subcontractors

– Business Loans from private banks, investors, government

– Wages, taxes to pay

The Liability in your company is classified by “Current” and “Long-Term Liability”. A current liability is a debt that must be pay within one year, and Long-term liability is due at any point after one year.

The liability should be understood as the creditor’s interest in your business.

EQUITY: Is the owner’s right to claim or have a financial interest in the business. It is called “shareholder equity” as well as “capital”. It is your company’s net worth. Its items include:

– Retain Earnings from previous years; accumulated profit or losses from previous periods.

– Net Profit current year; profit or loss

– Owner’s Draws

– Owner’s Distributions

– Owner’s Contributions.

The Equity should be understood as what is left over for the owner after you have subtracted all the liabilities from the assets.

As we explained at the beginning; the Balance Sheet is one of the three principal financial statements along with Profit & Loss and Cash Flow statements.

Thus to have a whole picture of your company’s financial position it is important to analyze the three statements. This analysis is based on ratios which are classified as Liquidity Ratios, Efficiency Ratios, Leverage Ratios, and Profitability.

The analysis of your company’s Balance Sheet allows you to know:

– Your company’s capacity to pay its current obligations is called: Current Ratio

– Your company’s success in employing the company’s assets to generate profit is called: Return on Assets (ROA)

– Your company’s success in maximizing return on the owner’s investment which is called: Return on Equity (ROE)

– How much debt a company is using to finance its assets which is called: Debt Ratio

– How much debt the company has relative to its owner’s equity which is call Debt-to Equity

As a part of the analysis, knowing your company’s ratios allow you to compare them throughout the years to competitors and to the industry’s average ratios.

The knowledge of your company’s ratios from the Balance Sheet and the other Financial Statements (Profit & Loss, Cash Flow) gives you the power to make informed decisions and improve your company’s financial performance.

Leave A Comment